So there it was on every front page this morning: Fortis, one of the largest banking and insurance companies in the Netherlands has been nationalised. What’s more, it’s been nationalised by no less than three countries: Holland takes over 49 percent of the insurance branch and pays 4 billion dollars, Belgium pays 4.7 billion for the same percentage of the banking branch, while Luxembourg invests 2.5 billion euros in the Luxembourg based interests of Fortis. Finally, the ABN Amro bank, which Fortis had just bought the Dutch branch off less then a year ago is to be sold, perhaps to ING, another finance giant, best known for taking over Barings when Nick Leeson had managed to bankrupt it…

So far the effects of the American mortgage crisis and subsequent credit crunch seemed to have barely hit the Netherlands, but with this part nationalisation it seems we too are no longer immune to it. The big question is whether Fortis is just the first to fail, or whether like the UK or America, we’ll see the whole financial sector collapse like a house of cards. There are other banks who, like Fortis, had to write off investments in the American mortgage markets this year and last, but none of these losses, including those of Fortis are big enough on their own to bring down any of the big banks. What made Fortis vulnerable was much simpler: a decision to get involved in a long and expensive hostile takeover at the exact moment that it became clear just how much of a disaster the US mortgage situation really was. This meant that Fortis had to find billions of euros it didn’t have itself to pay for its share of ABN AMro at a time when nobody was willing or able to lend it to them as cashw as tied up in the every increasing death spiral of the US mortgages.

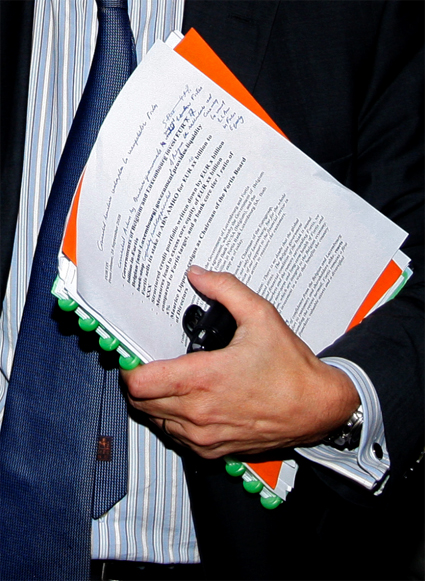

So Fortis lost a lot of money, its shares plummetted and its customers moved their savings to other, more safer banks. Despite frequent denials and optimistic press releases, the end was near. Negotiations between Fortis and the Dutch, Belgian and Luxembourg governments started this weekend, and when one Fortis executive left the meeting on Sunday night, details of the rescue plan were clearly readable on the concept agreement he flashed the press, as seen in the picture. Which is how we know ABN Amro is to be sold and the chairman will lose his job, as officially only the part nationalisation has been agreed upon.

I’ve got mixed feelings about this. While it’s fun to gloat about how quickly dyed in the wool capitalists are converted to “socialism” when it’s their ass on the line, this isn’t the kind of socialism that actually benefits the workers themselves. What’s more, with the current plan the government doesn’t even get a controlling stake in Fortis, so has little to show for its generous investment. And generous it certainly is to pump four billion euros into a doddering company when plans to provide e.g. daycare for everybody founder on millions rather than billions. It puts the lie to the oft heard argument that “we just can’t afford” higher social benefits, or improved healthcare, or anything else that would actually improve the lives of ordinary people. Especially when you see how much money Fortis has wasted chasing after ABN Amro…